To get to the point of being truly data driven, your firm needs to know where you’ve been and where you currently stand in your path to data maturity. It’s important to follow this model because trust is built along this path - it is impossible to make important strategic decisions based on data without trust that your data and systems are reliable.

Read MoreLike any real estate operation, there is data flowing everywhere: from weekly leasing reports to FMV and return data. Origin Investments focuses on constantly improving their aggregation and reporting processes so that they can continue to differentiate the Origin investor experience from that of a traditional fund.

Read MoreAn interview with Jim Bolduc, Senior Managing Director at JPB Partners about the opportunities and challenges facing consumer-focused private equity investors

Read MoreMaintaining GP and LP alignment is a challenge. We discuss the various ways to mitigate misalignment through data and reporting.

Read MoreThink back to the interview you did for the current job you’re working at. You most likely got your job from your work experiences and accomplishments, not the clothes you wore that day or the paper you presented your resume on.

Read MoreWhen I hear about “referrals” I often to think about raffles, giveaways, and other monetary incentives. After speaking with Josh Haymond, partner at VACO, my ideals have changed. Referrals at the enterprise level are more about creating deep, “help me help you” relationships than they are about creating short-term financial incentives.

Read MoreInvestors working with private companies experience the same free and ubiquitous access to data that much of the tech industry realized in the late 2000’s but have yet to capitalize on the opportunity. If you take a random sample of fund managers and ask them how they leverage data from due-diligence, portfolio monitoring, or their own fund’s operation, the answer generally encompasses a mix of analysts, cumbersome excel files, and CRMs. The data is available but locked in an antiquated system. Herein lies the opportunity.

Read MoreManagers at nonprofits have a unique set of challenges related to furthering their business while also furthering their mission. Progress cannot always be measured by simple metrics like revenue-growth and grants-made because you’re not really in the business of making money and giving money away: you’re in business to better the world...

Read MoreThe fact is, data transfer and data visualization are only two parts of the business intelligence equation. The third part, and the largest missing piece, is what you do with this information - how you gain actionable insights. The first step to understanding the difference between where you are and where you need to be is finding the benchmark.

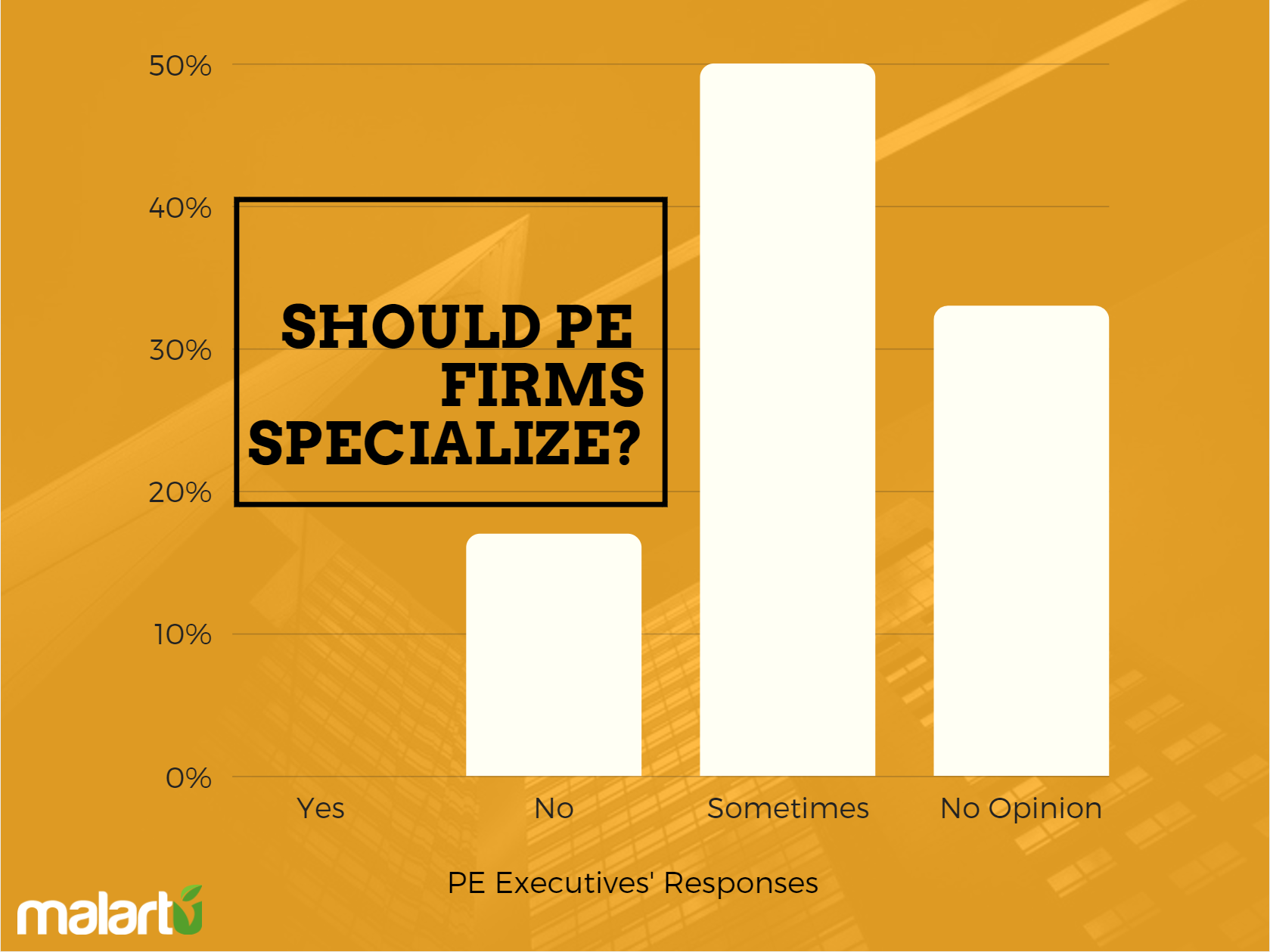

Read MoreMalartu sat down with twelve executives from PE and mezzanine funds and a handful of limited partners to talk current investment trends such as specialization, operating partners, co-investment, and secondary transactions. Read more to find out what we learned.

Read MoreLike traditional debt, mezzanine funds lend out money and in return expect a series of payments with added interest sometime in the future.

Read MoreWhen a visitor comes to a site that has the Google Analytics tracking code installed, Google Analytics captures data via cookies like what kind of traffic it is, where the visitor came from, their browser, screen resolution, country, metro, etc. Campaign tagging allows you to overwrite this data with your own custom variables to get better insight into who this visitor is and why they’re coming to your site.

Read MoreTo understand why the top private equity firms are like nurseries, we have to listen to Jack Dangermond, famed businessman and environmental scientist who said:

"In a nursery, if you don't take care of those plants, your profits get lost real quickly. You have to weed. You have to water. You have to nurture.”

Read MoreIf you read our newsletter and weekly update, you’ll quickly learn that we like data, and we like ranking things. Given our approach to middle market portfolio tracking, we set out to rank the top 10 areas to invest in middle market businesses. We’ll call these “high-growth, low-hype” markets, a phrase first coined by the co-founders of Frontier Capital, Richard Maclean and Andrew Lindner. But before we get to ranking, let’s talk briefly about high-growth, low-hype, and the middle market.

Read MoreInbound marketing is a consumer-centric marketing model that focuses on building a lasting brand image and attracting longterm consumers. Instead of forcing information on potential customers (outbound marketing), inbound marketing attracts customers to the firm organically. This shift in ideology from "push" to "pull" marketing tactics allows companies to focus on building and maintaining customer relationships based on a foundation of high-quality content aligned with company values. Inbound marketing, in a sense, is simply a form of customer education.

Read MoreIt’s fun working with early-stage companies, because every company and every situation is different. Some need to be set up, some are raising angel and venture capital, some need help with general contract negotiation and drafting, and others are on a hiring spree. However, a few things hold true throughout these diverse startup companies. For one, it takes a ton of work to make a new business successful.

Read MoreIn 1998, just a year after returning to lead the company he founded after a 12-year hiatus, Steve Jobs took the opportunity presented by a MacWorld address to confront Apple’s critics in public. During his appearance, he humorously outlined what he dubbed a “Hierarchy of Skepticism,” in order to make a clever, pre-emptive strike against the criticisms he’d inevitably face next.

Read MoreMeasuring a business's success can be a difficult task for many entrepreneurs running today's startups. Who or what's to say a business is successful? Does generating revenue mean success? Questions like these can create a lot of sleepless nights for entrepreneurs. However, there are ways to answer these types of introspective questions. Use your business' metrics as a measure of success.

Read MoreNot all metrics are created equal. It takes time, effort, and a strong understanding of your business to identify the best metrics to track for your situation. Metrics fall into two categories for most companies: vanity metrics, or actionable metrics (Key Performance Indicators). Today, we are discussing what exactly makes a vanity metric so we can either avoid tracking something of no value, or better yet, turn that metric into a KPI. To start, let's take a look at the definition of vanity.

Read More