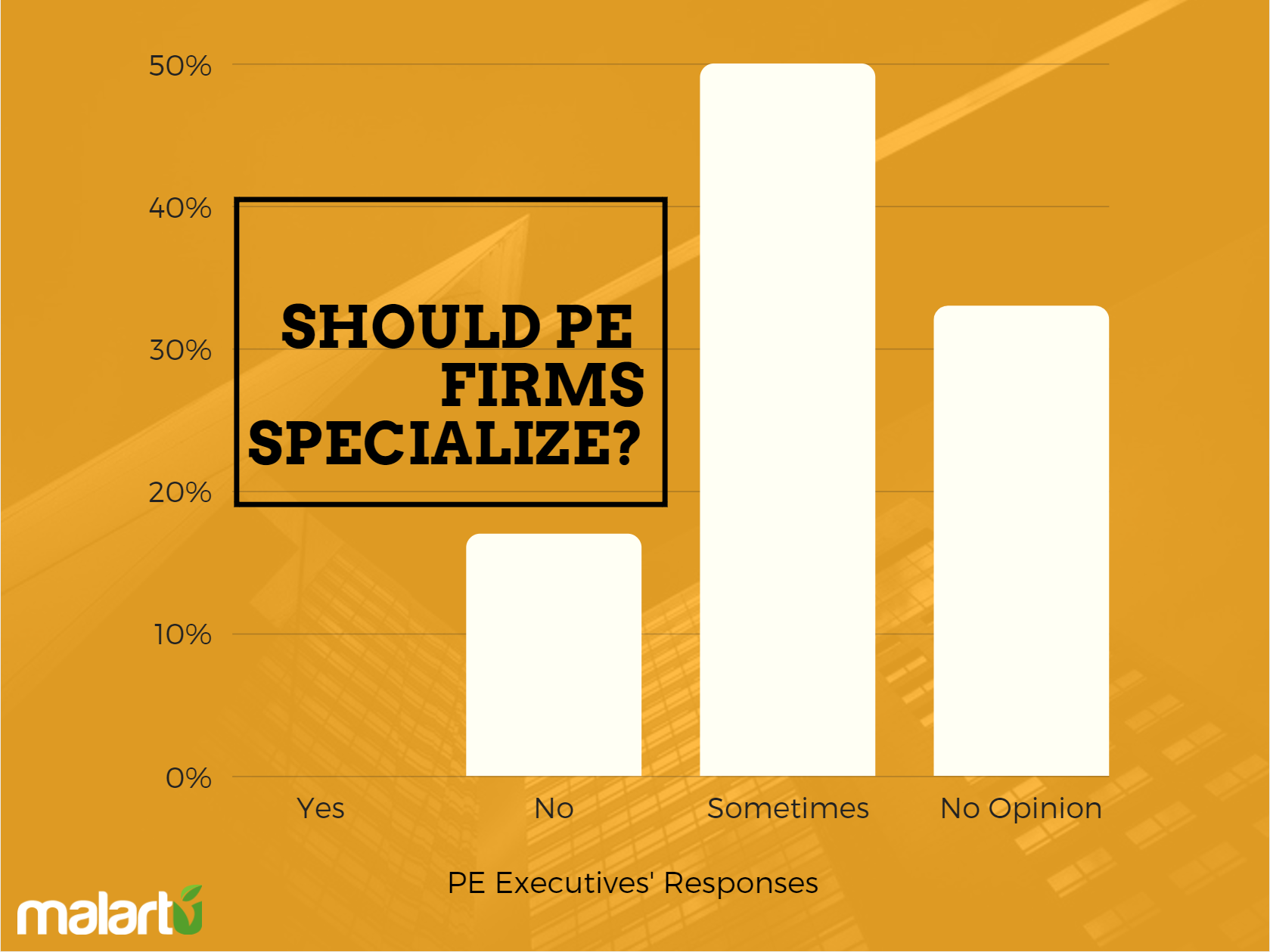

Malartu sat down with twelve executives from PE and mezzanine funds and a handful of limited partners to talk current investment trends such as specialization, operating partners, co-investment, and secondary transactions. Read more to find out what we learned.

Read MoreLike traditional debt, mezzanine funds lend out money and in return expect a series of payments with added interest sometime in the future.

Read MoreTo understand why the top private equity firms are like nurseries, we have to listen to Jack Dangermond, famed businessman and environmental scientist who said:

"In a nursery, if you don't take care of those plants, your profits get lost real quickly. You have to weed. You have to water. You have to nurture.”

Read MoreIf you read our newsletter and weekly update, you’ll quickly learn that we like data, and we like ranking things. Given our approach to middle market portfolio tracking, we set out to rank the top 10 areas to invest in middle market businesses. We’ll call these “high-growth, low-hype” markets, a phrase first coined by the co-founders of Frontier Capital, Richard Maclean and Andrew Lindner. But before we get to ranking, let’s talk briefly about high-growth, low-hype, and the middle market.

Read MoreInbound marketing is a consumer-centric marketing model that focuses on building a lasting brand image and attracting longterm consumers. Instead of forcing information on potential customers (outbound marketing), inbound marketing attracts customers to the firm organically. This shift in ideology from "push" to "pull" marketing tactics allows companies to focus on building and maintaining customer relationships based on a foundation of high-quality content aligned with company values. Inbound marketing, in a sense, is simply a form of customer education.

Read More